Your Legacy Giving Starts here

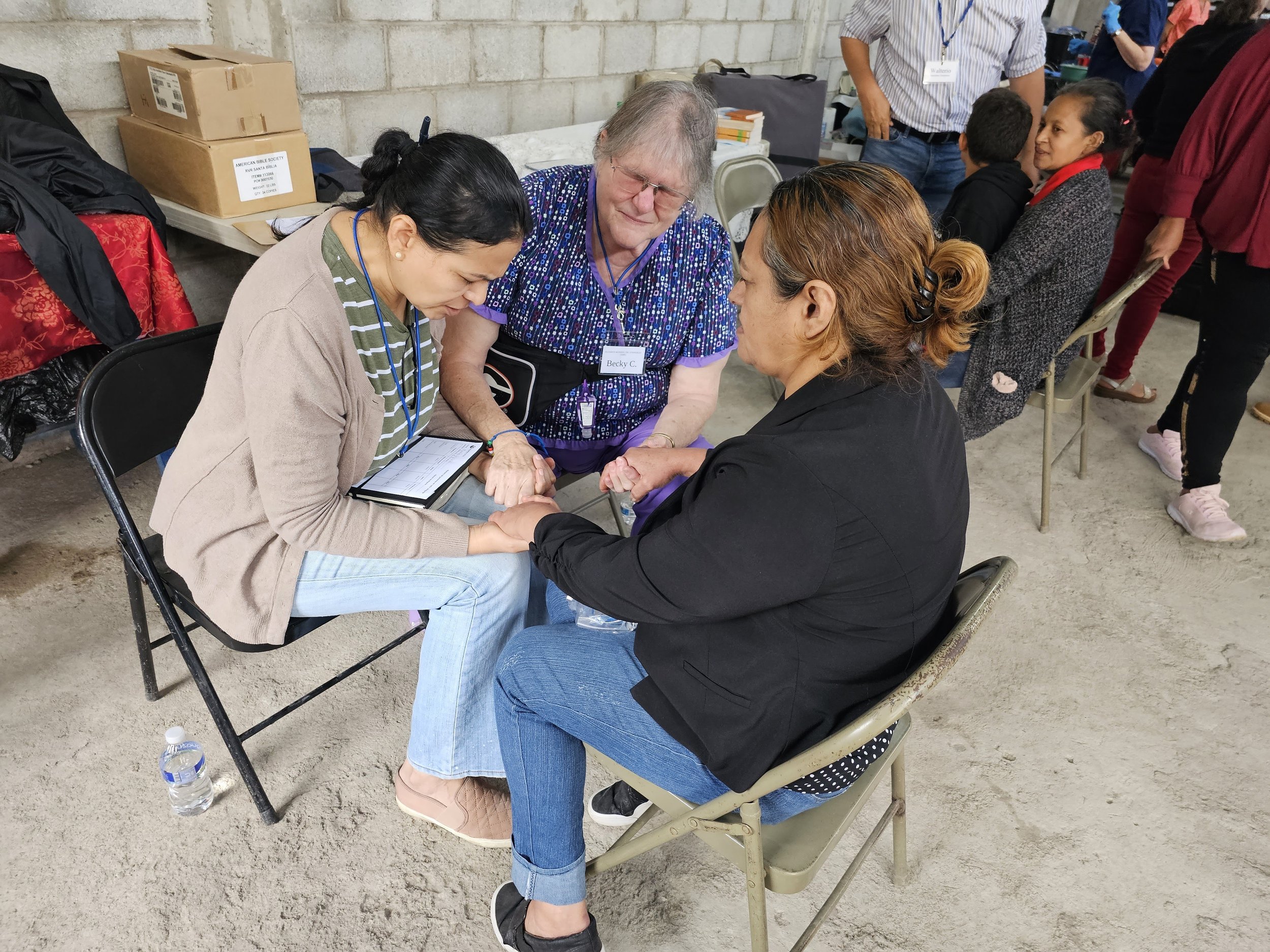

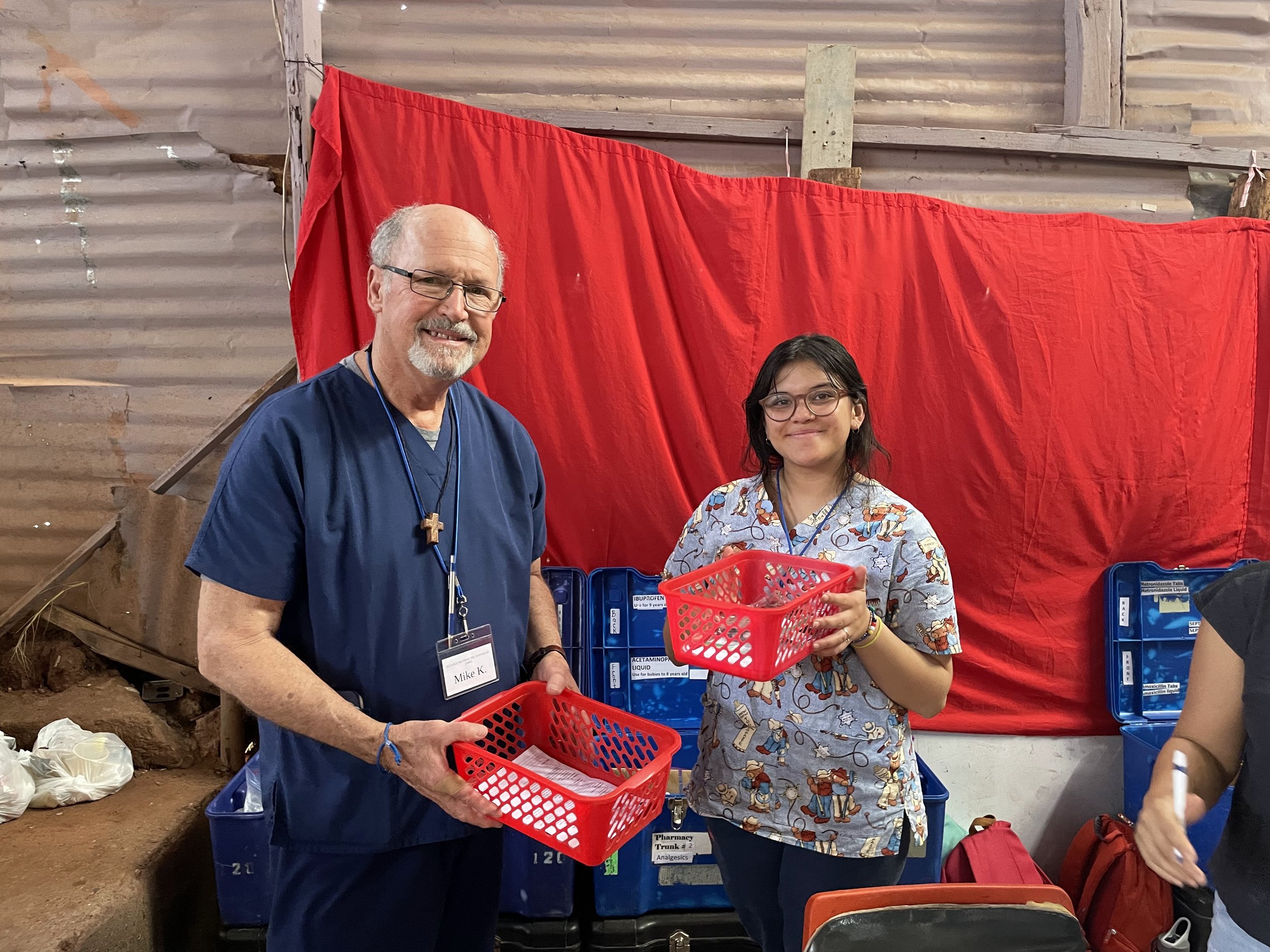

Will you Help WGO make a difference in lives in Honduras and Belize?

YOUR GIFT MATTERS

Even After Your Lifetime

Giving Strategies Concepts:

Lifetime (Annual) Giving:

-

• Donations are deductible for donors who itemize when filing their income tax returns. Overall deductions for donations to public charities, including donor-advised funds, are generally limited to 50% of adjusted gross income (AGI). The limit increases to 60% of AGI for cash gifts, while the limit on donating appreciated non-cash assets held more than one year is 30% of AGI. Contribution amounts in excess of these deduction limits may be carried over up to five subsequent tax years.

• Donors who itemize rather than take the standard deduction typically do so because the total of their itemized deductions exceeds their standard deduction amount. Inflation-based adjustments pushed standard deduction amounts for 2023 to new highs: single filers may claim a $13,850 standard deduction, while married couples filing jointly can claim a $27,700 standard deduction.

-

• This strategy is worth considering in any tax year, as it allows you to eliminate the capital gains tax you would need to pay when you eventually sell the appreciated asset, in addition to providing a deduction (if you itemize) equal to the fair market value of the asset when you donate it

-

• With this technique, you (the grantor) transfer assets to a trust in exchange for the right to pay an annuity to a charity for a set period of years. At the end of the trust’s term, any remaining amount in the trust — that exceeds the IRS’s 7520 interest rate (which adjusts with market interest rates) — transfers to the trust’s beneficiaries without gift or estate tax.

What if you are:

-

• A QCD is an otherwise taxable distribution of up to $100,000 from an IRA to a qualified charity. This distribution counts toward your required minimum distribution (RMD) if you are over 70 1/2 and is excluded from your taxable income, even if it exceeds your RMD.

-

• Generally, beginning at age 59 1/2, you can take withdrawals from most retirement accounts without penalty. In combination with the temporarily increased charitable deduction limit, this means you can reap similar QCD benefits: take a cash distribution from your IRA, gift the cash to a public charity and offset the income tax consequences attributable to the distribution by taking a charitable deduction equal to 100% of your AGI. This strategy does have broader implications, as it increases your AGI and prematurely removes assets that would otherwise grow tax-free, but it could make sense if you have significant charitable intentions and a large percentage of your assets in retirement accounts.

Planned Giving:

-

A donor-advised fund (“DAF”) is like an investment account that’s solely for the purpose of making charitable donations to organizations you care about. Cash, appreciated assets, or real estate can be gifted to an investment account for the benefit of the charity (or charities) the donor chooses.

Benefits to a Donor Advised Fund:

—-> Current income tax deduction

—->·Donor can choose when to gift and to whom

-

• A gift in your will or trust is a meaningful way to support a charity close to your heart. A charitable bequest, which is a gift in your will, is an easy and flexible way to ensure the charity that has impacted your life will continue on far after you are gone.

-

Charitable Remainder Annuity Trust:

Assets gifted to trust, which in turn pays a fixed amount to donor for a period of time, usually life. At the end of the term, assets are distributed to charity.

Benefits:

• Current income tax deduction

• Annual income to donor

• Possible deferral of capital gains tax

Charitable Remainder Unitrust:

Assets gifted to trust, which in turn pays a variable amount to donor for a period of time, usually life. At the end of the term, assets are distributed to charity.

Benefits:

• Current income tax deduction

• Annual income to donor

• Possible deferral of capital gains tax

• Additional contributions permitted

-

• Options:

—-> List the charitable organization as your beneficiary.

—-> Add a charitable giving rider to your life insurance policy.

—-> Put your policy in a trust.

—-> Donate a permanent life insurance policy to the institution.

Mike Merdinger, Partner

O: 312.831.4370

mmerdinger@myprivatevista.com